georgia property tax relief for seniors

Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your. Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies.

Large Numbers Take School System Property Tax Exemption The Citizen

Coronavirus Tax Relief FAQs.

. Our staff has a proven record. Individuals 65 Years of Age and Older. Property Taxes in Georgia.

The tax for recording the. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. 48-5-40 When and Where to File Your Homestead.

A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. Any Georgia resident can be granted a 2000 exemption from county and school taxes. It was founded in 2000 and has been an active.

Boasting a population of nearly 11 million Fulton County is Georgias most populous county. The tax cut would benefit more than 300000 Georgians and make Georgia a more attractive location for retirees. Its population is diverse.

Alabama exempts senior citizens over the age of 65 from paying a state portion of property taxes. Property Tax Homestead Exemptions. CuraDebt is a company that provides debt relief from Hollywood Florida.

Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a. Individuals 65 years or older may claim an exemption from. HB 1055 also eliminates the state portion of homeowners.

County Property Tax Facts. Del Webb Chateau Elan The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up. Does Georgia offer any income tax relief for retirees.

Non-military seniors in South Carolina can enjoy a homestead. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. CuraDebt is a company that provides debt relief from Hollywood Florida.

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. New Yorks senior exemption is also pretty generous. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens.

About the Company Georgia Property Tax Relief For Seniors. It was founded in 2000 and has since become a part of the. Press Releases For more information about the COVID.

Property Tax Returns and Payment. Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts etc. About the Company Georgia Seniors Relief Of School Tax.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently. A Guide to Claiming Fulton County Property Tax Exemptions for Seniors. People who are 65 or older can get a 4000 exemption.

2019 Income Limit Set For Gwinnett Senior Property Tax Exemption

Tangible Personal Property State Tangible Personal Property Taxes

Georgia Homestead Exemption Reminder Brian M Douglas

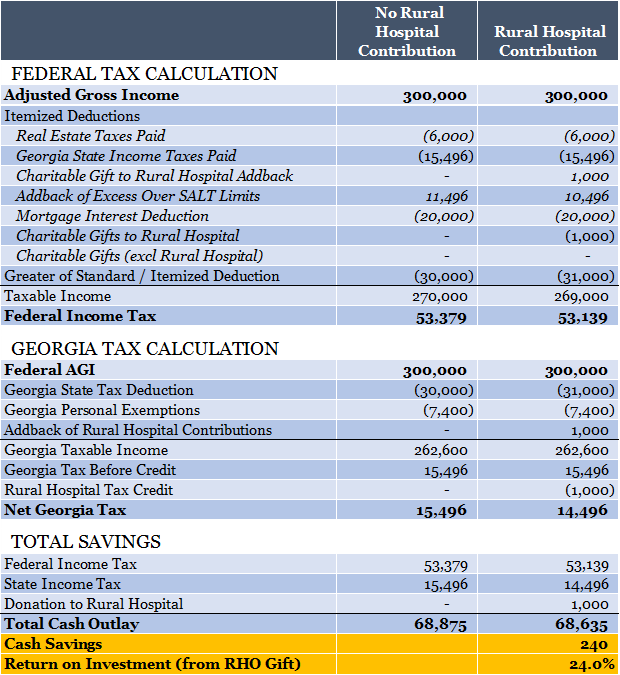

The Newly Expanded Tax Credit That Every Georgia Taxpayer Should Understand Resource Planning Group

Coronavirus Covid 19 Impact On Your Property Taxes 𝗢𝗮𝗸𝗧𝗿𝗲𝗲 𝗟𝗮𝘄

These Are The Ballot Measures You Can Vote On In The Georgia Midterm Election Wabe

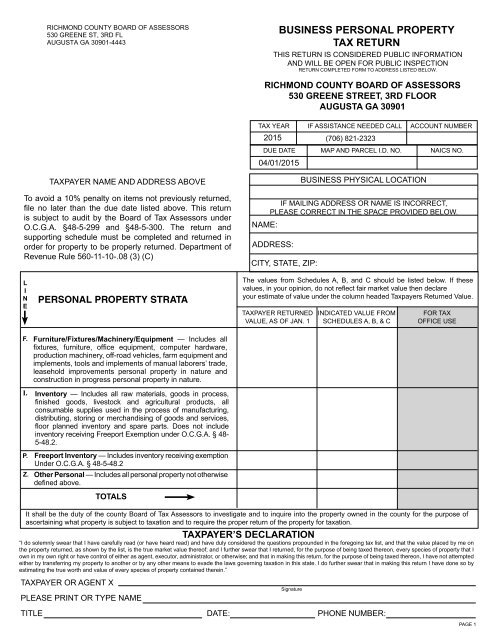

Business Personal Property Tax Return Augusta Georgia

Brookhaven Seeks Property Tax Savings For Homeowners Reporter Newspapers Atlanta Intown

Age Based Property Tax Exemptions In Georgia

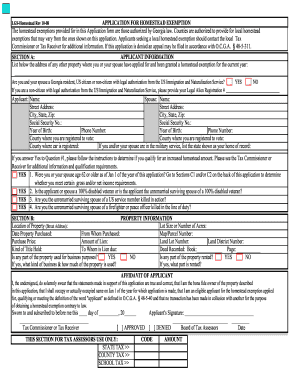

Dekalb County Ga Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Vehicle Taxes Dekalb Tax Commissioner

Case Study 2 Property Tax Deduction For Owner Occupied Housing Tax Foundation

Tax Exemptions For Senior Homeowners In Georgia Red Hot Atlanta Homes Active Adult Experts

18 8 Property Tax Exemptions In Georgia Georgia Real Estate License Realestateu Tv Youtube

Deducting Property Taxes H R Block

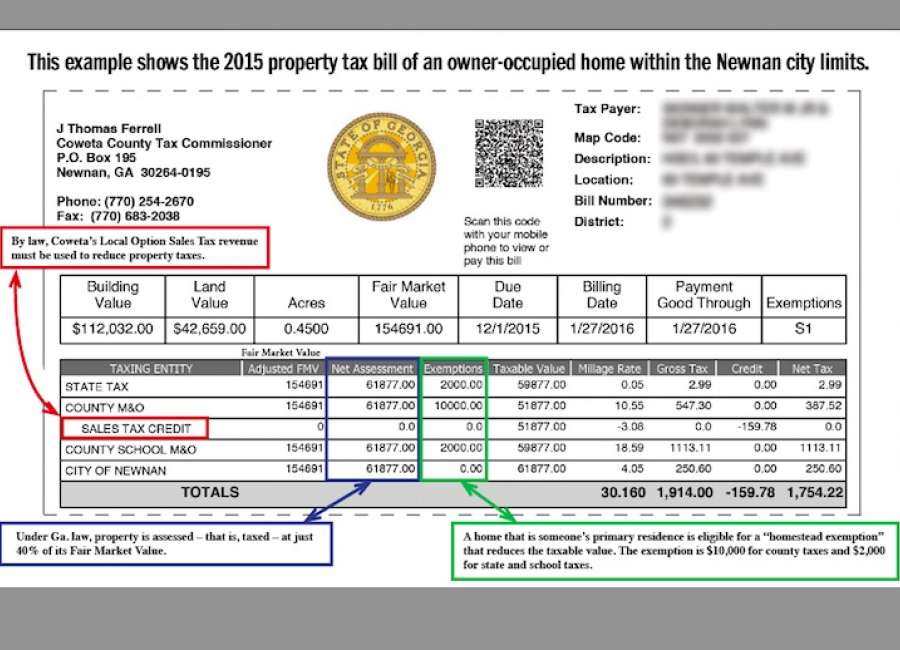

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

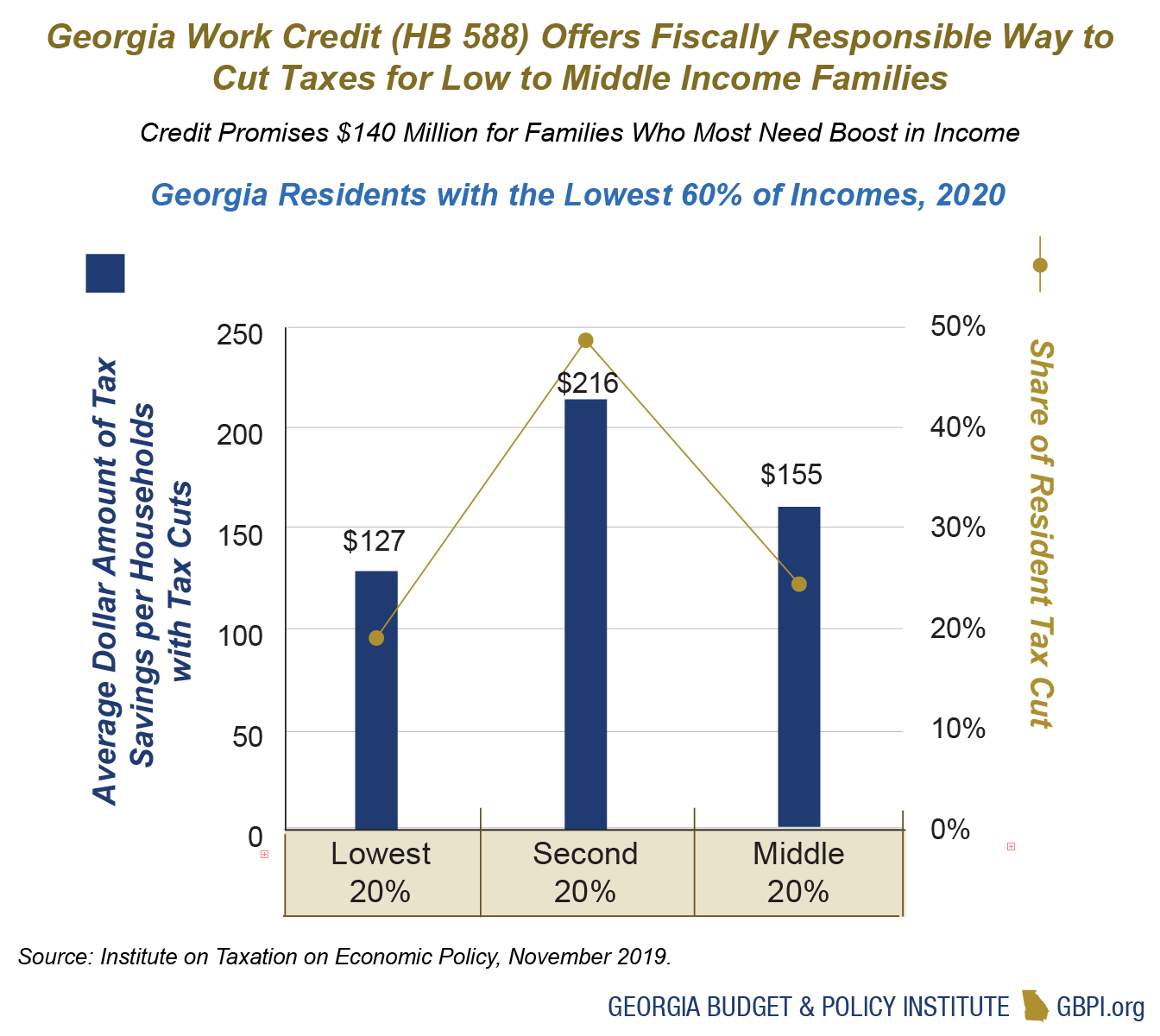

Georgia Leaders Face Choice Between Tax Cuts For High Income Earners And Funding Key State Priorities Georgia Budget And Policy Institute