does the irs write off tax debt after 10 years

Its not exactly forgiveness but similar. See How for Back Taxes Help.

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

End Your IRS Tax Problems.

. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Youll benefit from the cancellation of. Money Back Guarantee - Free Consultation.

End Your IRS Tax Problems. 435 46 votes. After that the debt is wiped clean from its books and the IRS.

We Can Help Suspend Collections Liens Levies Wage Garnishments. In general the internal revenue service irs has 10 years to collect unpaid tax debt. However some crucial exceptions may apply.

Ad See the Top 10 Ranked IRS Tax Relief in 2022 Make an Informed Purchase. Tax Attorney Explains Expiring Tax Debts. The day the tax.

After that the debt is wiped clean from its books and the IRS writes it off. The IRS are limited by law on how long they can write to you and try to collect. As already hinted at the statute of limitations on IRS debt is 10 years.

Generally speaking the Internal Revenue Service has a maximum of ten years to collect on unpaid taxes. After that the debt is wiped clean from its books and the IRS writes it offThis. Why the 10-Year Statute.

As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. The statute of limitations that the IRS has to collect a tax debt is typically ten years. After a debt is canceled the creditor.

Specifically Internal Revenue Code 6502 Collection After. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of. In this event the.

After that time has expired the obligation is entirely wiped clean and removed. BBB Accredited A Rating - Free Consultation. Limitations can be suspended.

After that the debt is wiped clean from its books and the IRS writes it off. The IRS generally has 10 years to collect on a tax debt before it expires. Does the IRS Forgive Tax Debt After 10 Years.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. After that the debt is wiped clean from its books and the irs writes it. The IRS does have the authority to write off all or some of your tax debt and settle with you for less.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years. The short answer to this question is yes the IRS tax debt does expire after 10 years. End Your IRS Tax Problems.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Ad As Heard on CNN. These specific exclusions will be discussed later.

But it does come to an end. This is called the 10 Year. However there are a few things you should know about this expiration date.

BBB Accredited A Rating - Free Consultation. Ad As Heard on CNN. Ad Worry-Free Tax Solutions.

455 70 votes. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Money Back Guarantee - Free Consultation.

The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Its important for taxpayers to find out if their accounts are exempt from the ten-year rule so that they can prepare themselves if the IRS decides to pursue collection. End Your IRS Tax Problems.

Tax Debt And Irs Collection Solutions Faqs Irs Mind

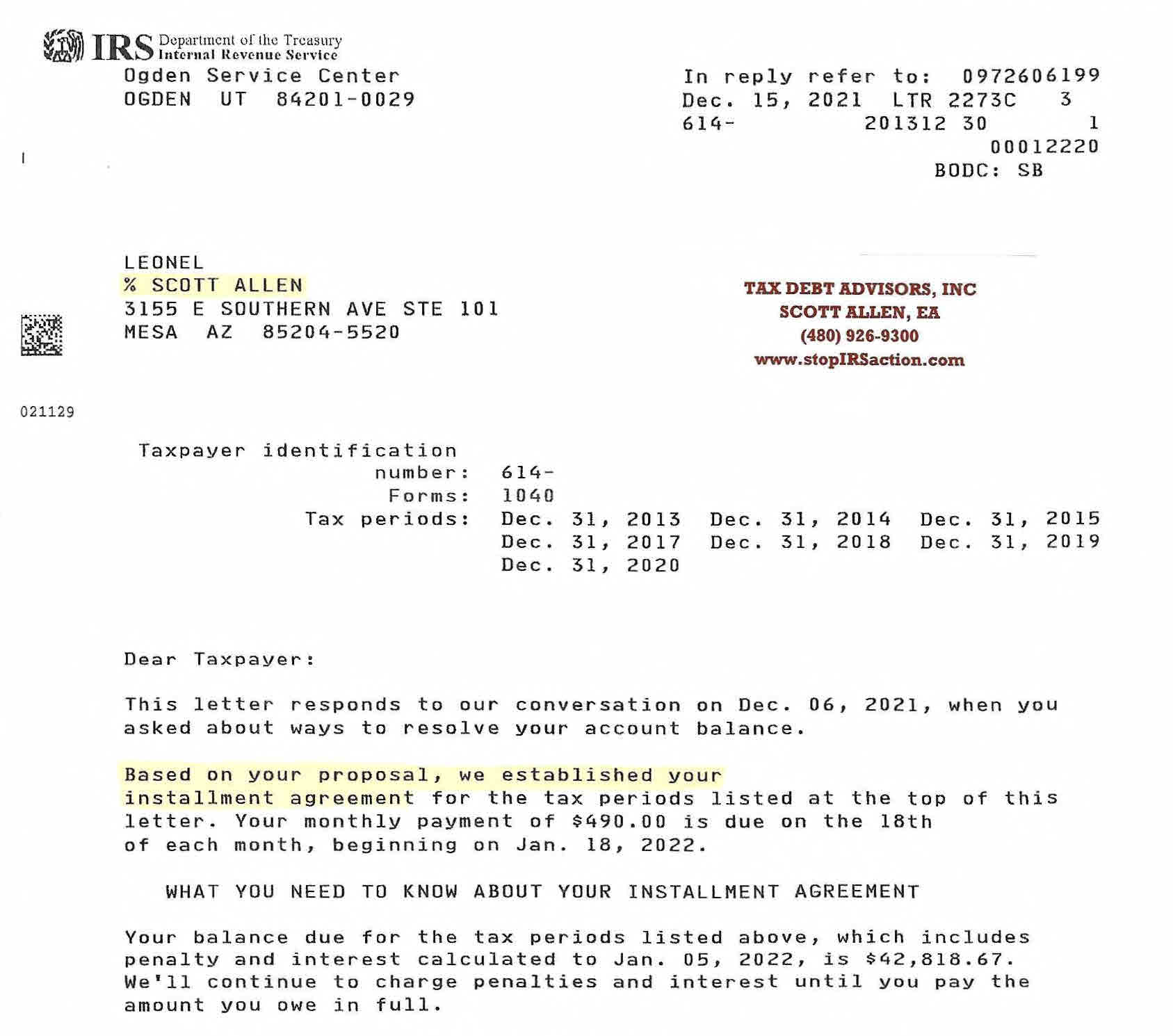

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Does The Irs Forgive Tax Debt After 10 Years

Tax Debt Relief Irs Programs Signs Of A Scam

Irs Tax Debt Relief Forgiveness On Taxes

Does The Irs Forgive Tax Debt After 10 Years

Irs Tax Audits Tax Debt Advisors

Are There Statute Of Limitations For Irs Collections Brotman Law

Irs To Individuals With Significant Tax Debts Act Now To Avoid Passport Revocations Diplopundit

How Long Can The Irs Try To Collect A Debt

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

Irs Tax Letters Explained Landmark Tax Group

Tax Debt Relief Real Help Or Just A Scam Credit Karma Tax

Can The Irs Take Or Hold My Refund Yes H R Block

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning