santa clara property tax exemption

You can pay tax bills for your secured property homes buildings lands. Propositions 60 and 90 are pieces of legislation that allow homeowners 55 or older to move into a new home without substantially increasing their property tax obligation.

How Does Property Tax Work In Texas Quora

Please check back in August 2022 for updates.

. Send a Message Call. Free California Property Tax Records Search. Learn more about SCC DTAC Property Tax Payment App.

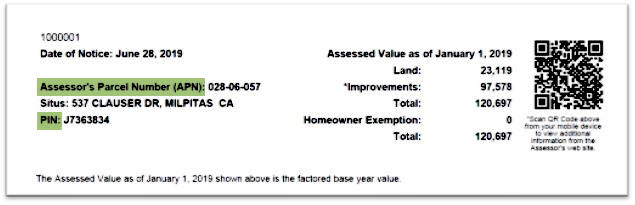

View and pay for your property tax billsstatements in Santa Clara County online using this service. Quickly search property records from 19 official databases. The Assessors Office allows residents to view free of charge basic information about properties in Santa Clara County such as assessed value assessors parcel number APN document number property address Assessor parcel maps and other information.

A Homeowners Exemption also may apply to a supplemental assessment if the property was not previously receiving a Homeowners Exemption on the regular Assessment Roll. The Department of Tax and Collections does not maintain a. The County Assessor is responsible for listing and valuing all taxable real and personal property in Washington County.

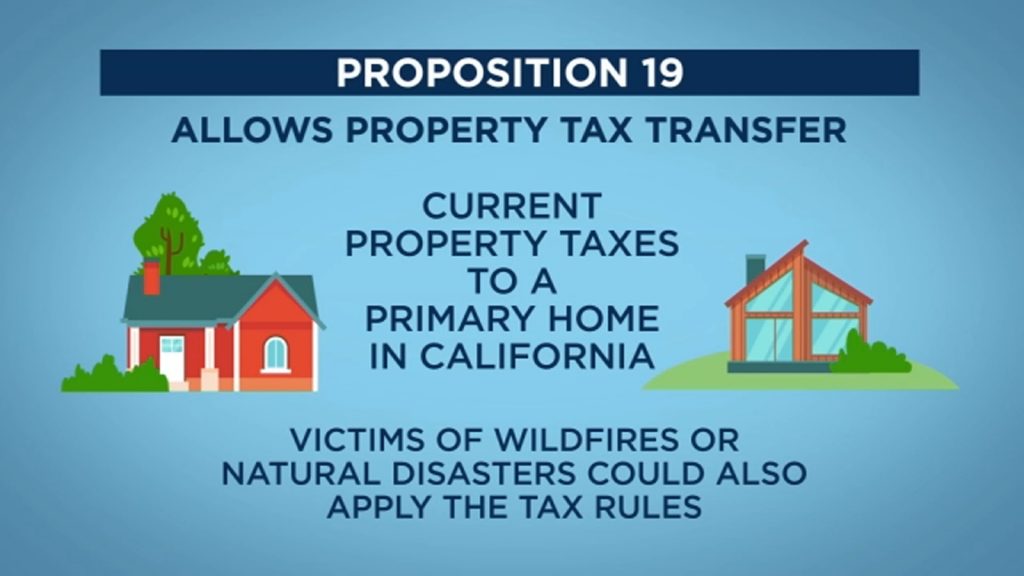

Proposition 19 allows wildfire victims to transfer the property tax base of a primary residence to a replacement property purchased in any county in California after 412021. Property Tax Exemption for Senior Citizens and People with Disabilities Accessed Jan. This article will show you some of the most common property tax exemptions for seniors and how to determine whether youre eligible for them.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. Mobile home property search. See detailed property tax information from the sample report for 4605 N Millbrook Fresno County CA The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

The median annual property tax payment in Santa Clara County is. RTC Revenue and Taxation Code Section 693 may be the best option if your replacement property is located in one of the 13 counties that has adopted an ordinance to. The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home.

The median home value in Santa Clara County is among the highest in the nation at 913000. California property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions. PROPERTY TAX ASSISTANCE PROGRAM.

Looking for FREE property records deeds tax assessments in Santa Clara County CA. Create a free account and review your selected propertys tax rates value assessments and more. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina.

Special Permit A special permit is necessary for uses presumed to be generally appropriate within a zoning district but whose intensity impact or other characteristics require discretionary review. Currently you may research and print assessment information for individual parcels free of charge. PROPERTY ASSESSMENT INFORMATION SYSTEM.

It does not reduce the amount of taxes owed to the. Because of these high home values annual property tax bills for homeowners in Santa Clara County are quite high despite rates actually being near the state average. Find California residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more.

59-2-1035 for property in this state that is the primary residence of the property owner or the property owners spouse that claim of a. The home must have been the principal place of residence of the owner on the lien date January 1st. California Propositions 60 and 90.

The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Information and procedures to have the zoning of a property interpreted for a specific use or to apply for a rezoning or zone change for a property. Also known as the Gonsalves-Deukmejian-Petris Property Tax Assistance Law this program provides direct cash reimbursements from the state to low-income seniors 62 or older blind or disabled citizens for part of the property taxes on their homes.

Application for Residential Exemption or Request a paper application via. The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. The claim form BOE-266 Claim for Homeowners Property Tax Exemption is available from the county.

North Carolinas median income is 55928 per year so the median yearly property. 435 634-5703 If a property owner or a property owners spouse claims a residential exemption under Utah Code Ann.

Schaumburg Township Senior Tax Exemption Change Tax Exemption Property Tax Schaumburg

Milpitas Community Briefs For The Week Of April 15 The Mercury News

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Real Property Tax Division Department Of Revenue And Taxation

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Understanding California S Property Taxes

Property Tax Re Assessment Bubbleinfo Com

Business Property Tax In California What You Need To Know

Property Taxes Department Of Tax And Collections County Of Santa Clara

Company News Archives Invoke Tax Partners

Industry News Invoke Tax Partners

How Does Property Tax Work In Texas Quora

Property Taxes Department Of Tax And Collections County Of Santa Clara

Business Property Tax In California What You Need To Know

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News